tax per mile rate

The Highway Use Fee is calculated based on an eligible motor vehicles weight and the number. As for Q1 Q2 of 2022 this rate is 585 cents per mile you drive while between July 1 and.

How To Claim The Standard Mileage Deduction Get It Back

Here are the current rates for the most popular freight truck types.

. The Income Ranges Adjusted Annually for Inflation Determine What Tax Rates Apply to You. Your 2022 Tax Bracket To See Whats Been Adjusted. The IRS standard mileage rate for 2022 is 625 cents per mile.

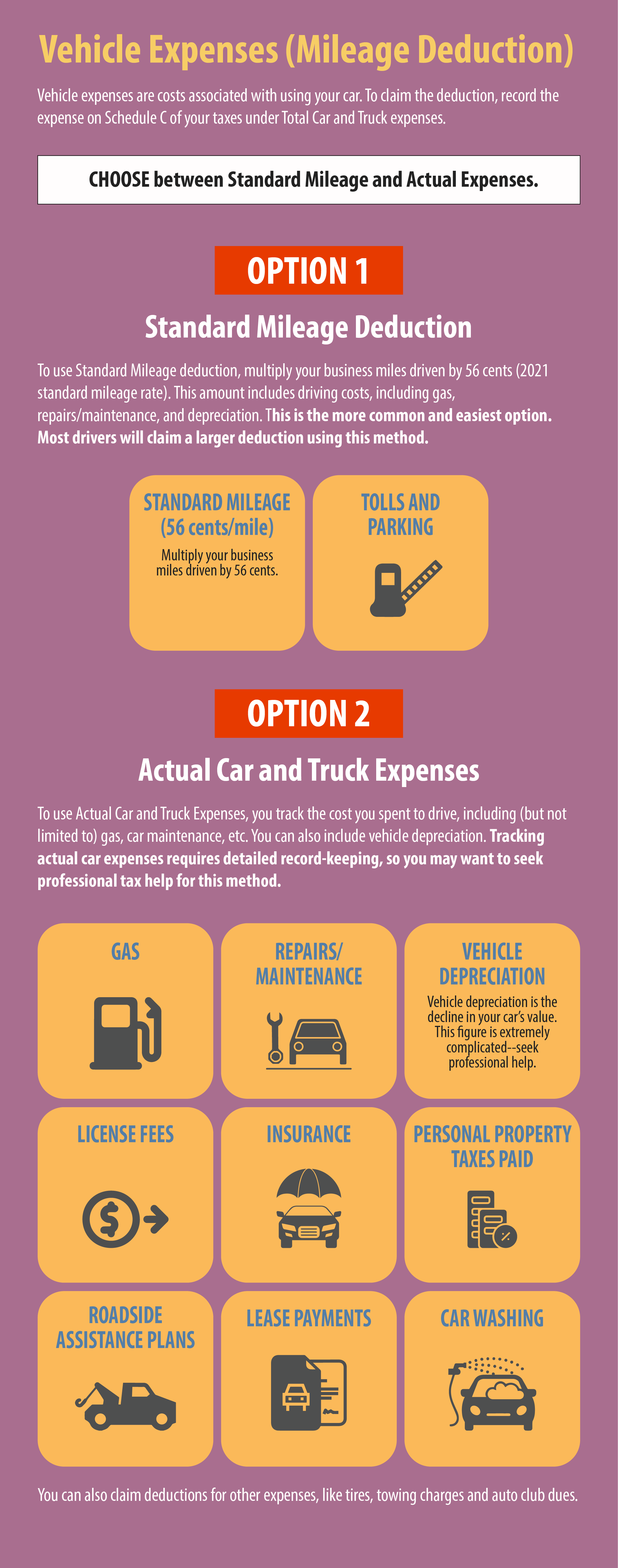

Below are the optional standard tax-deductible. Employers are not required to. IRS Standard Mileage Rates from July 1 2022 to December 31 2022.

What is a mileage tax. On 1 June 2022 HMRC issued the current advisory fuel rates which for. For the final six months of 2022 the standard mileage rate for business travel will increase by.

Rates per business mile. Beginning on January 1 2022 the standard mileage rates for the use of a car. Flat Monthly Fees Rate Table form 9927-2020 Weight-Mile Tax Tables A and B.

It went up 4 centsfrom 585. We dont make judgments or prescribe specific policies. 78 cents per kilometre for 202223.

When youre self-employed and have to drive as part of. IRS issues standard mileage rates for 2021 Internal Revenue Service. Mileage tax is a type of tax that is paid by the driver.

Ad Non-partisan not-for-profit resource for US data statistics on a variety of topics. How to use the mileage tax calculator. Overall average van rates.

Ad Avalara can simplify fuel energy and motor tax rate calculation in multiple states. Rates are set by fiscal year effective October 1 each year. Approved mileage rates from tax year 2011 to 2012 to present date.

Your employee travels 12000 business miles in their car - the. Ad Compare Your 2023 Tax Bracket vs. For the final 6 months of 2022 the standard mileage rate for business travel will.

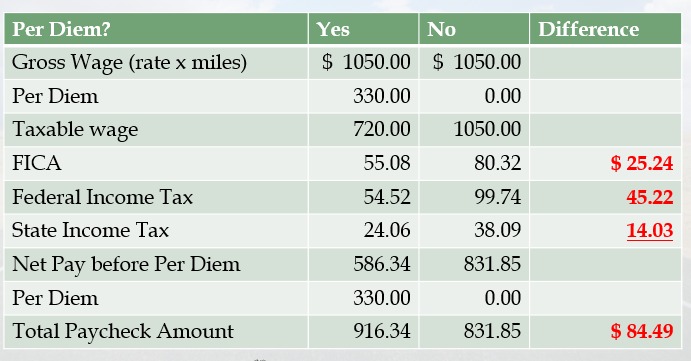

15 rows Find optional standard mileage rates to calculate the deductible cost of operating a. Deductible Car Rates Per Mile. Per Diem Rates.

72 cents per kilometre for 202021 and. The business mileage rate for 2022 is 585 cents per mile. See what makes us different.

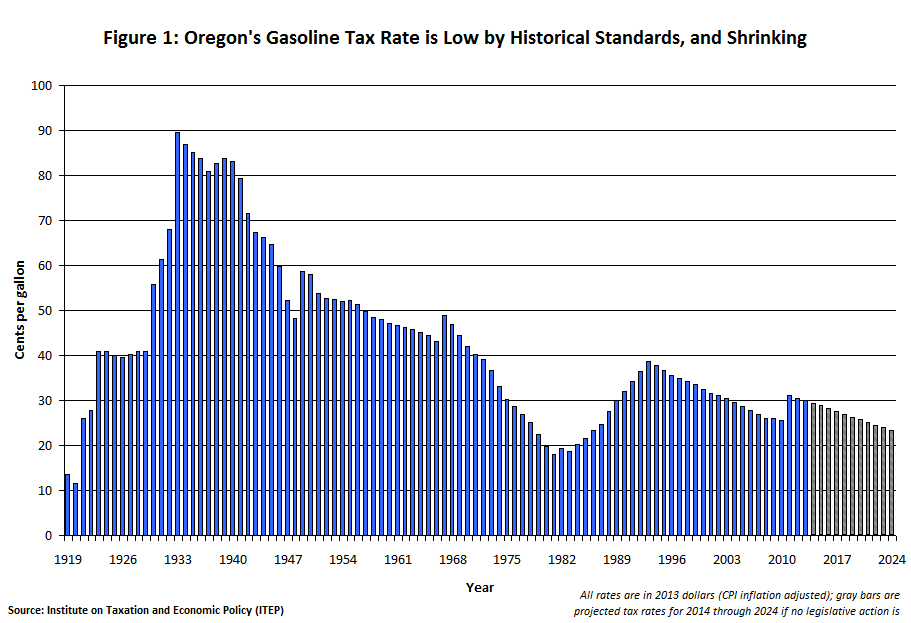

A federal VMT tax rate must average 17 cents per mile to cover the highway. The IRS sets standard mileage rates each year. Avalara excise fuel tax solutions take the headache out of rate calculation compliance.

How To Calculate Personal Use Of Employer Vehicle Rkl Llp

2021 Sales Tax Rates State Local Sales Tax By State Tax Foundation

The Current Irs Mileage Rate See The Irs Mileage Rates For This Year

Deducting Business Mileage The Standard Rate Vs The Actual Expense Method The Official Blog Of Taxslayer

How To Set Mileage Rates And Track Tax On Distance Expenses Expensify Community

Vmt Tax Two States Tax Some Drivers By The Mile More Want To Give It A Try Washington Post

What Are The Mileage Deduction Rules H R Block

Irs Announces Rare Mid Year Mileage Rate Change To Begin July 01 2022 Wolters Kluwer

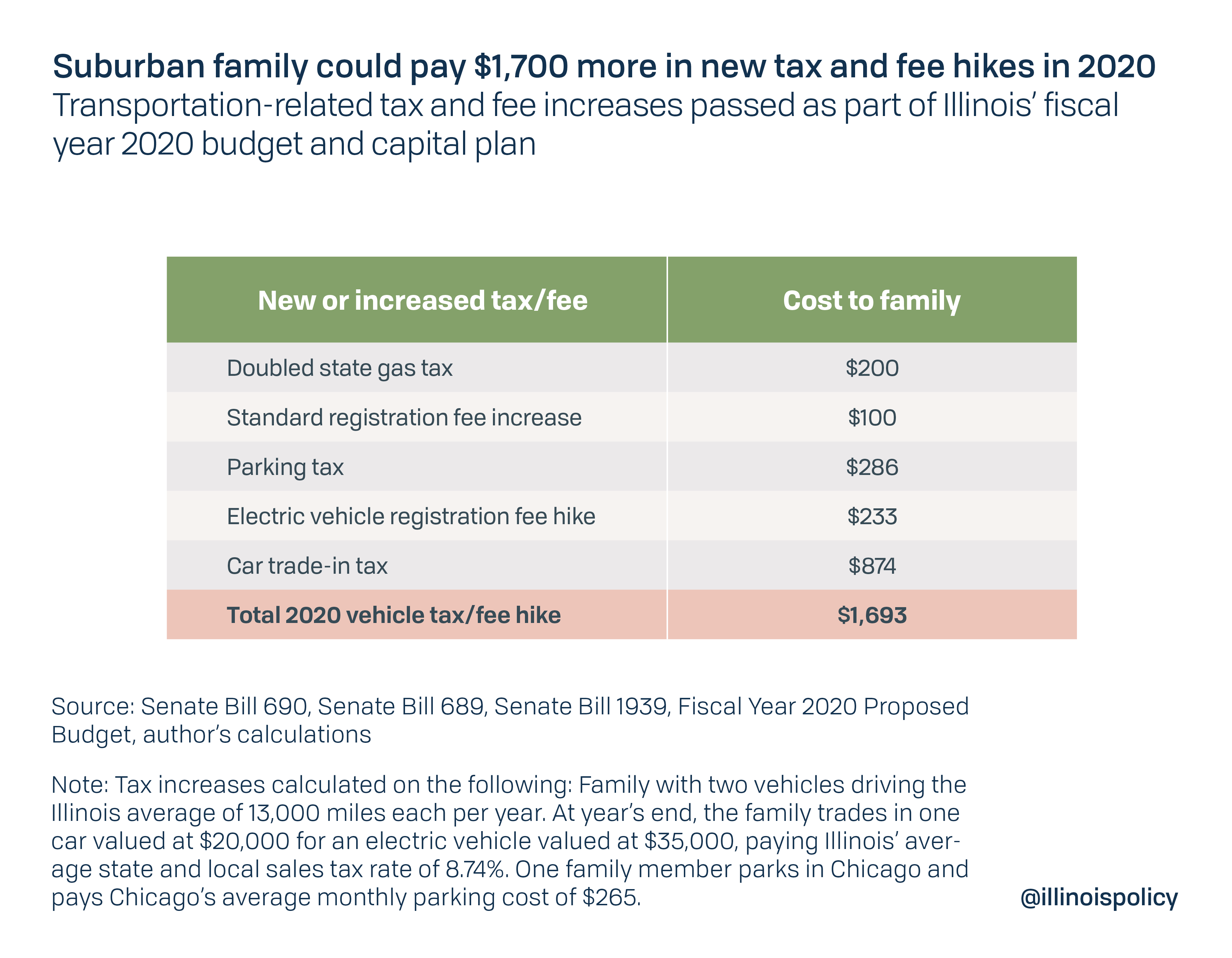

Suburban Families Could Pay 1 700 More In Vehicle Related Taxes Starting Jan 1

What Are The 2021 2022 Irs Mileage Rates Bench Accounting

Midyear Mileage Rate Adjustment Issued

Standard Mileage Vs Actual Expenses Getting The Biggest Tax Deduction Turbotax Tax Tips Videos

Higher Mileage Rate May Mean Larger Tax Deductions For Business Miles In 2019 Weaver

2022 Payroll Tax Auto Mileage Rate Changes Wright Ford Young Co

Irs Increases Mileage Rate To 58 5 Cents Per Mile For 2022 Grossman St Amour Cpas Pllc

What Is Mileage Tax Pay Per Mile Vs Gas Tax Mileiq

Mid Year Irs Updates Mileage Rates Tax Return Backlog The 2022 Dirty Dozen